Bitcoin and cryptocurrencies have been on a roller-coaster ride in 2020 / 2021, much like the majority of the time since its inception. Volatility tends to be exhibited more prominently in assets that are yet to reach their full maturity, and such effects should be expected and considered normal.

The real question all the institutions want to find the answer to is this “Is Blockchain Technology, Bitcoin and other cryptocurrencies mature enough and the right fit for institutional adoption?” Let us dissect all the moving parts unbiased so that an objective denouement can be reached after all the relevant data has been considered.

Utilise Volatility to Your Advantage

Volatility often considered a negative attribute when describing investible assets, maybe more of a friend than a foe if leveraged correctly. One must bear in mind that volatility works both ways and does not necessarily imply that an asset is downwards trending.

Cryptocurrencies are, at the time of writing this article, volatile due to several factors. One of the significant factors is that it is still in its infancy, and many investors are still “speculating” on how this intangible digital asset class can be fairly valued. The illiquid nature of the cryptocurrency market brings large swings to its price, as any large injection or withdrawal of capital could move the market. Even the most prominent cryptocurrency by market cap, Bitcoin, is only a measly 600b USD as of writing, i.e. around 30% of the market cap of Apple Inc (AAPL). Even the whole cryptocurrency market as a whole is considerably smaller than Apple alone.

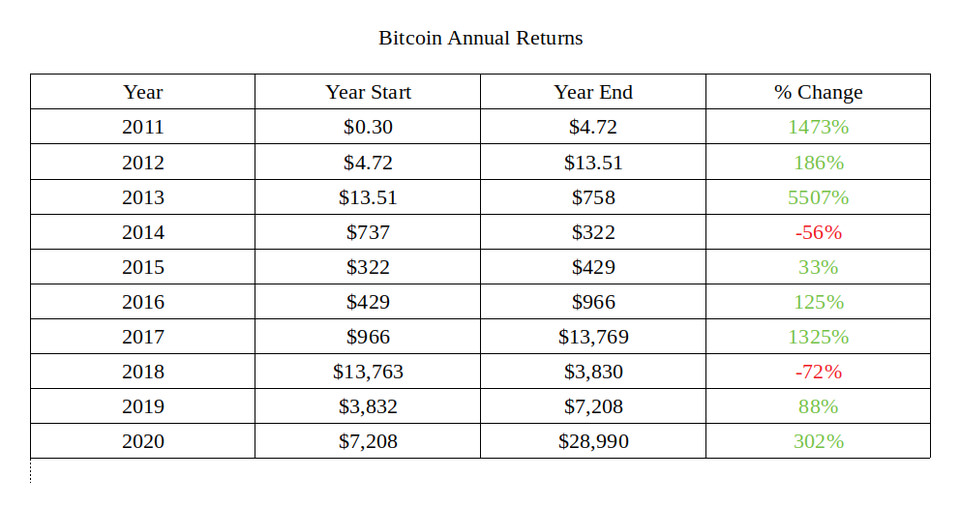

The current size and state of the cryptocurrency market present a simple opportunity: room for growth. It is tempting to focus on the daily or weekly price swings, which can typically be in the double-digit percentages, but one is encouraged to zoom out and gain some perspective. With growth, however, inherently brings volatility.

(Source: Internet)

The only growth path is through volatility. By focusing on the annualised returns, we can objectively assess whether the asset performance yields desirable results, although one must bear in mind that this only serves as a singular indicator and past performance is no guarantee of future results.

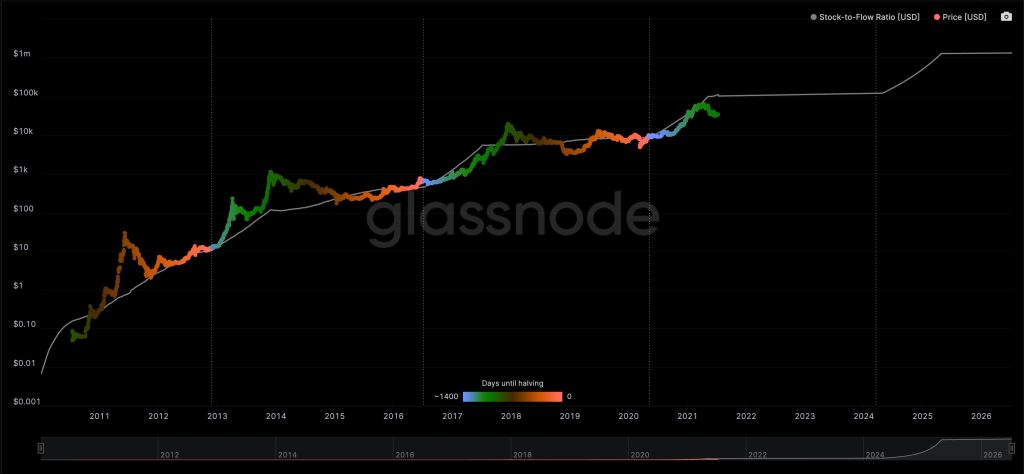

The Cryptocurrency Cycles in Motion

The cryptocurrency market cycles through bull and bear phases every four years (approx) and is primarily driven by the Bitcoin halving event. The halving event of Bitcoin is where the reward for mining new Bitcoin is halved, i.e., cutting the amount of Bitcoin coming into circulation through miners by 50%. Broadly speaking, this causes a delayed cascading effect of Bitcoin scarcity and supply shock, thereby causing the price to trend up.

But why do other cryptocurrencies also rise or fall in value as the halving event is specific to Bitcoin? Simply put, all cryptocurrencies closely correlated with each other, similar to any assets in their own asset class such as stocks. As Bitcoin is the first cryptocurrency and largest by market cap to date, all other cryptocurrencies are paired with $BTC for trading purposes, in addition to traders utilising Bitcoin as a market sentiment driver/indicator. Therefore, if Bitcoin suffers a fall, usually other cryptocurrencies take a larger tumble as data shows traders trade other coins back into Bitcoin during periods of uncertainty in a bid to secure profit and minimise loss.

Will other cryptocurrencies ever fully untether from Bitcoin? Very unlikely in the near future, however, there are times when other cryptocurrencies may temporarily untether from Bitcoin, and these scenarios are outlined below:

Generally, the tethering behaviour of prices between Bitcoin and other cryptocurrencies can be observed in adhering to the following:

As institutional interest spills over from Bitcoin into other large-cap cryptocurrencies like Ethereum, understanding the dynamics of how altcoins tether to Bitcoin is imperative. Markets overall can be highly unpredictable, and even more so with cryptocurrencies. Fortunately, the correlation between Bitcoin and altcoins provides some predictability level, and these behaviours should be acknowledged when institutions consider any investment into cryptocurrency.

Inverse Correlation Between $BTC and DxY

Since Bitcoin’s inception, the historical data tells us that there is a robust negative correlation between Bitcoin and the DxY.

(Source: TradingView)

The US Dollar Index (DxY), first introduced in early 1973, represents the US dollar value and relative strength against six other major currencies – GBP, CAD, JPY, EUR, CHF and SEK. So why is there such a strong inverse correlation between the two? It isn’t as counter-intuitive as we think.

(Source: TradingView)

The key takeaway here is that despite the relatively bullish momentum swing since March 2020 for cryptocurrencies, one of the macro indicators that cannot be overlooked is the trending direction of DxY. A stronger dollar generally indicates a sell-off in assets and cryptocurrencies, and it is fair to say, as, at the date of this article, the DxY is indeed oversold and looking to rebound.

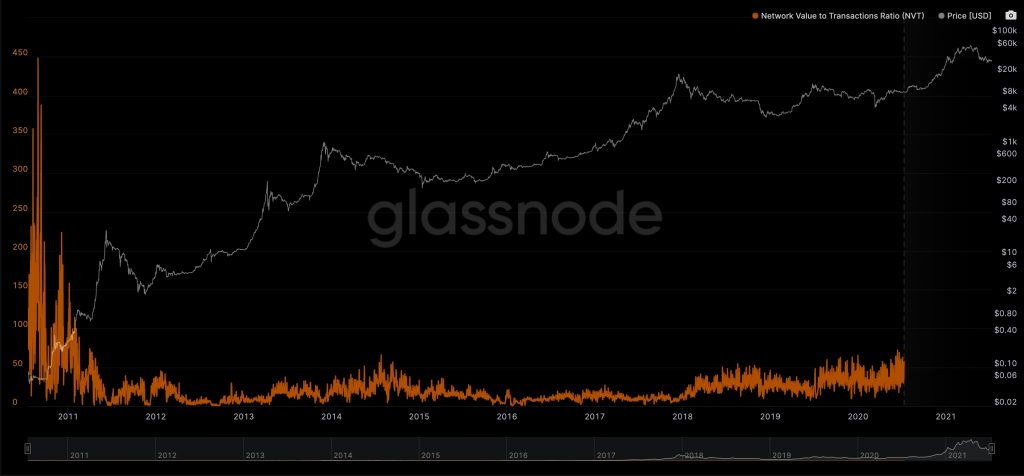

On-chain Metric: What is it and can it be trusted?

One of the unique features of cryptocurrencies is its underlying Blockchain Technology which is being slated as tamper-proof with no single point of failure. The majority of Blockchains indeed exhibit these qualities, although one must carry out due diligence as not all Blockchains are created equal.

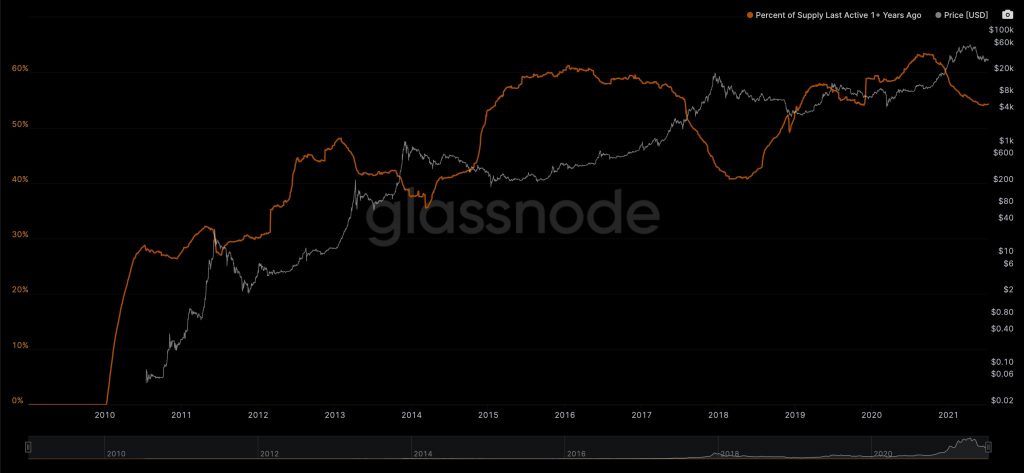

The possibility of accessing publicly available on-chain data has given birth to a whole new area of analysis via on-chain data. Pseudo-anonymity allows all wallets to be viewable but makes it difficult to determine who owns or has access to any particular wallet. The level of decentralisation (in Bitcoin, for example) ensures a high level of integrity in the on-chain data. In turn, accurate data yields extremely accurate trends and analyses.

Some insightful statistics can be derived from on-chain data, and some of the most discussed are listed below:

With a new avenue of “truth” to explore in the bid to get a glimpse into the future, we must always keep the most important fundamental principle in mind – whilst the on-chain data is undisputed in its accuracy/integrity, it remains challenging to predict future performance. The relative youth of Bitcoin and cryptocurrencies also mean that much of the on-chain analytics has had only a couple of “full true cycles” of data to work with. Therefore, it is expected that much calibration will happen in the years to come before we can get some genuinely reliable macro statistics.

The Bigger Picture: Inflationary or Deflationary Crisis?

As many economists would say, the impending crisis isn’t a question of if, but when. However, the pressing question is the market’s general indecision around whether the imminent crisis will be an inflationary or deflationary one.

The standard narrative amongst the mainstream media and many influential economists suggest that an inflationary crisis is about to occur. This is mainly due to the stimulus measures in place since early 2020. After all, approximately 40% of USD in existence (July 2021) were printed in the last 14 months. So in a way, the hyper-inflation narrative is warranted.

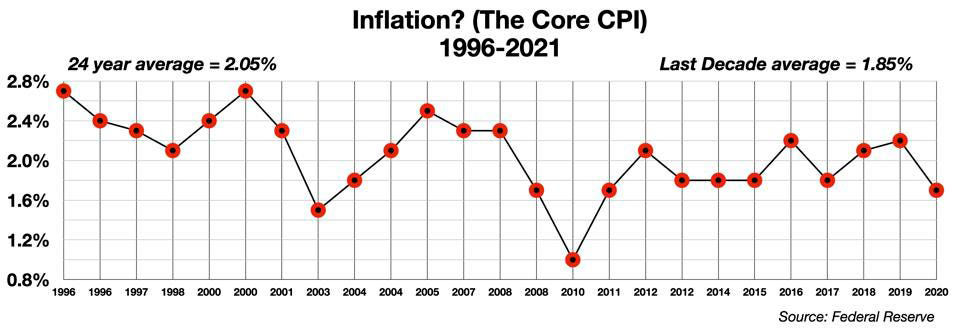

As with everything, relying on just a few indicators to conclude is a perilous journey to embark on. Paradoxically many other indicators hint at the underlying deflationary crisis, and one such indicator is the Core CPI which has never managed to exceed 3% in the last 25 years.

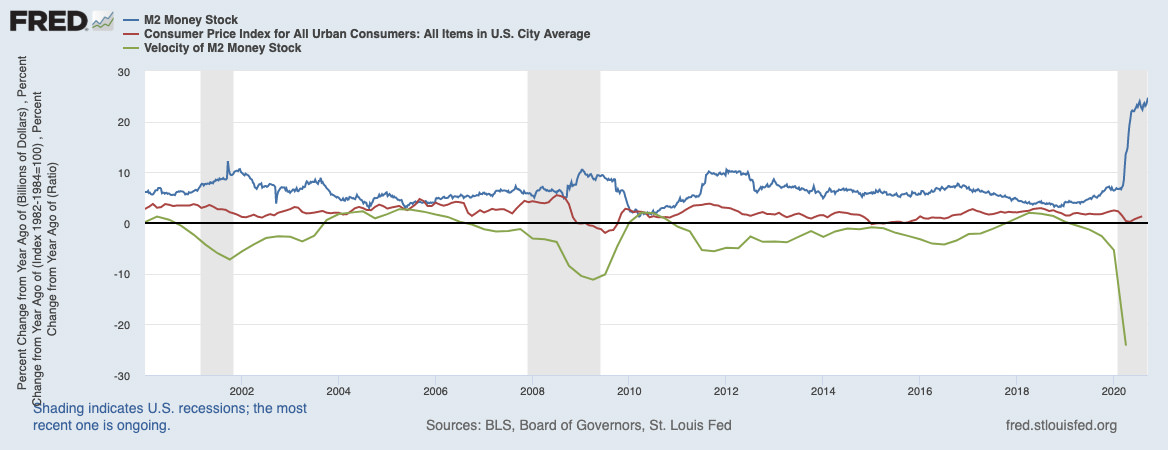

So how does inflation remain so low with such a significant surge in the M2 money supply? The incorrect assumption many make is that an increase in money supply equates to increased spending, thereby inflating the prices of all goods and services. The truth is, many of us are good at hoarding cash, and money sitting in a savings account does absolutely nothing for the overall economic activity. Due to such a significant spike in M2 Money Supply, “money velocity” has taken a nosedive as people are generally not transacting (that is, in proportion to the money being “printed”).

The world is in a precarious position right now. An inflationary crisis would fit the narrative that many mainstream media and economists are pushing. However, we run the danger of overreacting to an inflation scare which may be riskier than inflation itself. The narrative that assets such as Gold, commodities, and Bitcoin being hedges against inflation is widespread, even amongst institutions and businesses today. What if the world has already overreacted to a non-existent inflationary crisis and is about to fall off a cliff into a deflationary one? At least we are all in agreement that a situation is looming ahead, but the “when” and “what” remains as murky as ever.

Performance of Bitcoin During a Market Crash

Risk-on institutional investors must consider that Bitcoin and cryptocurrencies as a whole have yet to endure a severe market correction or recession properly. The ebb and flow of the prices so far are primarily driven by ~4-year Bitcoin halving cycles, generally governing the macro bull/bear cycles based on days post-halving. The latest recession, the Great Recession of 2008, saw the global GDP declined by more than 5%. However, this pre-dates Bitcoin inception, which saw an official network launch on the 3rd January 2009 but $BTC very much in its infancy at the time.

Bitcoin and cryptocurrencies have, however, suffered the infamous March 2020 crash, much like any other asset class, thereby citing that it is still closely correlated with stocks and commodities. Like the rest of the market, cryptocurrencies have since seen a V-shaped recovery and soared in value against the USD. The rally of Bitcoin and large-cap cryptocurrencies are driven mainly by the inflation hedge narrative, but has the market over-compensated and is the bubble about to burst?

(Source: TradingView)

There is no clear evidence that suggests Bitcoin, or any cryptocurrency will be immune or even hold value better than any other asset class during a global market downturn. For institutions, the mindset for considering investment into Bitcoin or any other cryptocurrency should be its potential to yield asymmetric returns on a macro timescale. When a macro mentality is adopted together with a risk-adjusted percentage of investment, short to medium term capitulations should be discarded and are irrelevant.

The Baby Elephant in the Room

Asymmetric investment opportunities often come from embracing an asset or asset class before it reaches mainstream adoption. Much like the Dotcom bubble, on the macro timeframe, it merely looks like a small bump when looking at the S&P 500 chart.

(Source: Google)

Time in the market almost always takes precedence over any other metric. Growth takes time, and nothing in the world goes up in a straight line. A healthy market corrects, often for an extended period, but the market is amazingly accurate at finding the fair “value” of any asset in the long run. Does this imply that all investments will yield a positive ROI on longer timeframes? Not. It still takes some foresight to funnel out the winners.

Blockchain Technology, the underlying technological layer that powers Bitcoin and cryptocurrencies, is the real untapped potential with mainstream adoption around the corner (years, in relative terms, short on a macro timeframe). Although Bitcoin helped spotlight Blockchain by providing a real-world use case, Blockchain Technology is now tipped to disrupt almost all industries and sectors in the near future. There are several critical reasons why Blockchain will bring much-needed upgrades to many (but not all) technologies that are now dated.

It isn’t every day that we encounter protocol layer technologies that could disrupt multiple industries at once. TCP/IP was the last prominent example, and it drew many parallels back in the 1980s to today’s Blockchain Technology. Much like the scepticism towards Blockchain Technology that many have right now, the TCP/IP model scaling up to become the internet of today was also inconceivable back then. The bold welcome change and embraces innovation. Will you keep up and push ahead or be left behind and made irrelevant?

An Innovative Mindset Front-runs an Innovative Strategy

Change should be the only constant, and complacency breeds contempt. Every day, individuals and organisations alike make a conscious decision to stay innovative and push forward or stay back in the comfort of familiarity. Having an innovative mindset needs to be a collective choice made organisation-wide, and such initiative is only effective when implemented at all levels.

However, the main drivers are high-level decisions made by the organisations at the C-suite level, which eventually trickle down and impact all individuals within the organisation. The relevance and involvement of Bitcoin, cryptocurrencies and Blockchain Technologies for institutions and organisations are 2-fold:

Although there isn’t a hard and fast rule that bundles the Treasury Strategy and the IP Investment into Blockchain Technology, they often go hand-in-hand. An innovative mindset often welcomes change on multiple fronts, and it is usually the ones that push the boundaries of their comfort zones that ultimately reap the immense rewards.

Closing Thoughts

Bitcoin and cryptocurrencies are powered by the underlying Blockchain Technology, which is set to disrupt many industries in the years to come. Even as the global economy looks on the edge of a looming crisis, the long-term growth projection for cryptocurrencies and Blockchain Technology adoption remains unchanged.

Institutions considering investments into cryptocurrencies or building IP via leveraging Blockchain Technology need to take a macro approach to ensure optimal ROI. Proper risk assessment and due diligence cannot be overlooked – and a risk-adjusted approach uniquely tailored to each organisation must be sought together with professional advice and necessary analysis so an informed decision can be made.

Strategy Hubb monitors and tracks the adoption of cryptocurrencies and Blockchain Technology in all industries and sectors. We are happy to accompany you on your journey to innovating your business model or add value to your organisation via Blockchain Technology adoption.

Disclaimer: Please note that the information provided in this article is not to be considered as financial advice. Please seek advice for your personal or business matters from a qualified professional or make contact with myself or one of the team at Strategy Hubb to tailor custom solutions to accommodate your circumstances.