“The word ‘resilient’ is of particular interest in a global market rife with uncertainty. To get through a pandemic, the two areas where resilience is required are in leadership and organisation. In hindsight, it is easy enough to point out faults in the direction taken by others, but much more complex when important decisions have to be made for the greater good of organisations. Moreover, when such decisions have to be made in a short time frame, the likelihood of miscalculation is intensified. There is no training manual for management under the COVID-19 pandemic, and we all continue to learn as the days, weeks and months pass by. Previous pandemics had certain characteristics in common, but none were exactly the same.”

Leadership and Resilience

Without solid leadership and the desire of all parties to act as one, a company will fracture and fail. Leaders and their personnel have to work cooperatively, in alignment, with their selected courses of action. This does not mean that no mistakes will be made, but these errors will be considered as part of a trial process to discover alternative value drivers within the company. The line of thought to adopt is that it is better to make small mistakes that do not come with significant risk, as high risk, can equate to catastrophic failure. Leaders need to take small, calculated steps to enable risk to be evaluated at every level. The utilisation of data should be mandatory in the decision-making process, as guesswork places companies at the mercy of chance.

Some companies are attempting their second pivot as lock-downs further prohibit regular business activity. The prolonged inability to function is slowly constricting the life and liquidity of organisations, great and small. The road to economic recovery eludes, and greater anxiety and stress are being felt by all countries, to varying degrees.

Points to Consider

- What type of leader are you?

- How resilient are you?

- How resilient is the organisation?

- How decisive is your leadership?

- Is your organisation open to change?

- How much of an influence does data play in your organisation?

- How fluid are your core revenue-driving strategies?

- How does your organisation mitigate risk?

- How much liquidity is left in the reserve tank?

- What measures have you taken to survive through the pandemic?

Where to from here?

As countries attempt to recalibrate and take stock of their losses, they measure the length and breadth of the holes that have emerged in the economy. Industry and its various segments are analysed to unravel what bridging measures will be required to set things straight. From a government perspective, stimulus packages are being directed toward job creation and job retention, while boards tackle the issues of higher priority within organisations. However, smaller companies do not have as much available support to aid with decision making at a higher level, and the casualties of private enterprise are mounting. Problems are being treated like casualties of war, whereby, the issues that have a higher probability of being solved are attended to, while critical issues are being left to bleed out.

The Loss of Small Business

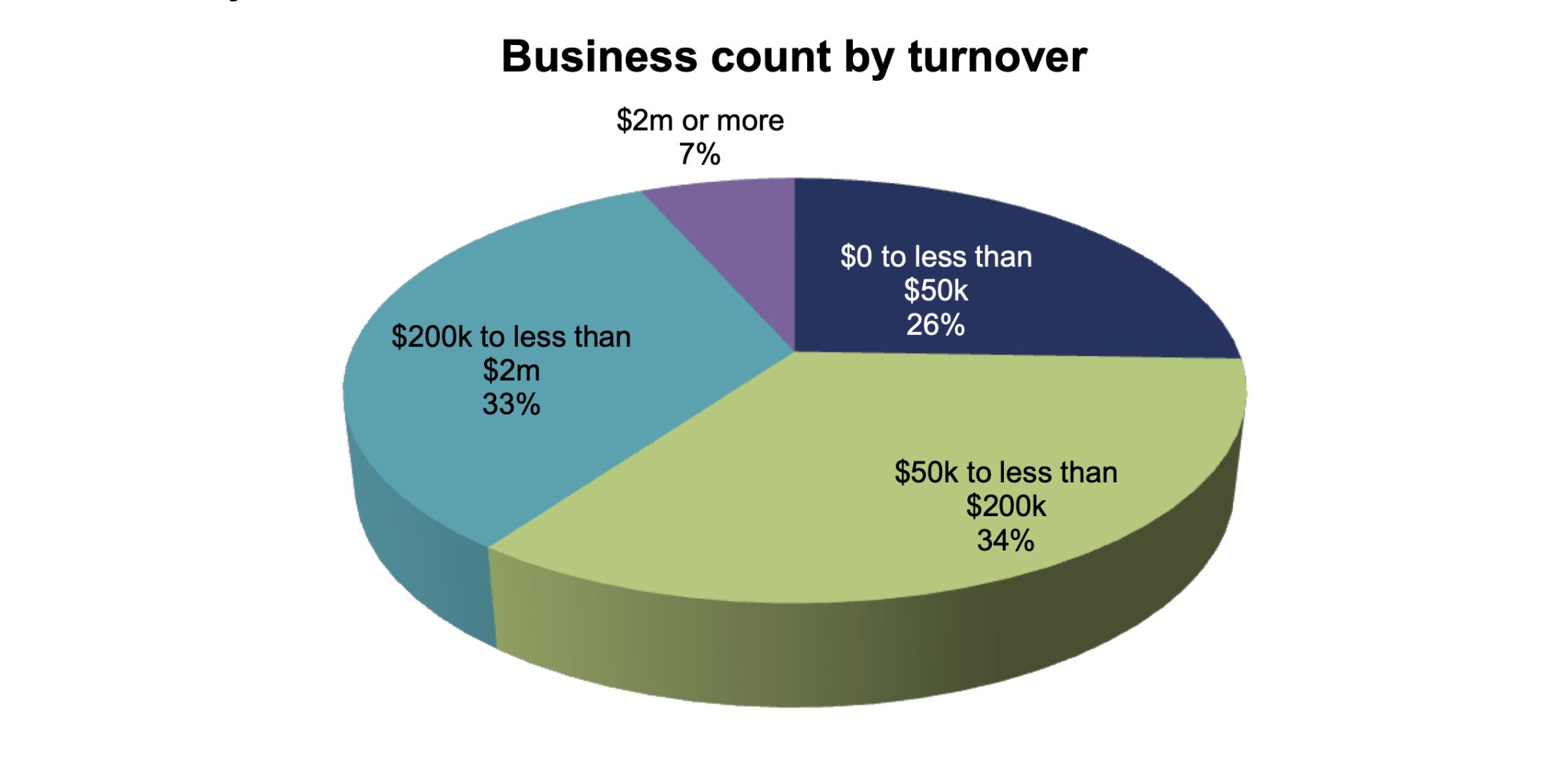

A significant percentage of Australian business is small business, as more small companies are servicing the livelihoods of everyday Australians, and are the life-blood of the economy. Medium to large scale businesses are the minority, but their contribution is significant. In 2019, Australia’s GDP stood at 1.85%; in sharp contrast, we are currently at -6.67% amidst the crisis. Small businesses account for 35% of Australia’s gross domestic profit and employ 44% of Australia’s workforce as recorded by the ‘Australian Bureau of Statistics.’ It is, therefore, imperative to fan the ambers of small business, to stabilise employment rates, and to kickstart the economy when lock-downs are scaled back. The worrying part of the Australian economy is its share of household debt. In 2018, statistics indicated that the percentage of household debt in the Australian Capital Territory was 81%. Showing that most households had some form of debt, including mortgages, investment loans, credit card debt, borrowings from other households and other personal and study loans.

Source: ABS Cat. No. 81040 Research and Experimental Development, Businesses, Australia.

Australia’s personal debt ratio is one of the highest in the world. Compounded by a recession, the mounting debt is likely to act as a hand brake on economic recovery. In 2018, ‘Statista’ indicates that the national debt of Australia amounted to around 532.58 billion U.S. dollars. In perilous times such as these, when small business is inactive, and larger enterprises are functioning at much lower capacities, the financial situation looks bleak without government stimulus, to prop things up. The mounting debt, against the backdrop of little to no income, is a recipe for disaster. Historic cycles dictate that, to climb out of a recession, there needs to be income and spending, to move the engine of economics. Without income, small business will fall away first, and parts of the local economy will cease to exist.

Ideas to Consider

There are options to consider for small businesses, as they wade through debt, and look to the skies for a brighter future. Here are some practical steps you can take to re-evaluate your situation:

- You can place your business on pause and wait out the pandemic. However, it is unlikely that you will be earning any income, but at least you will not be incurring any additional debt. This idea will only work if you have some liquidity to rely on until lock-downs cease.

- You can re-negotiate terms with your creditors, as these unusual times allow for restructuring. Laws have been put in place to work with you on some of these matters.

- You can defer debt to begin repayments sometime in the future. Have active discussions with your regular creditors to buy yourself time.

- Consolidate your debts, and look to reduce the interest payments on the total sum.

- You could seek to merge with an organisation that requires your business expertise. A merge should provide additional revenue options, or provide value as part of an existing revenue channel.

- Seek out external investment or new partners on a new venture.

- Sell off a portion of the company to at least survive the turmoil, or licence out a part of your business that can bring in monetary returns.

- If you have some fundamental Intellectual Property (IP) or value that has the potential to generate high yielding returns over time, then position to attract a keystone investor, or position for acquisition.

- Pivot to explore new markets or new models that allow you to drive revenue from a distance, through avenues like virtual consulting, for instance, to a global audience.

- Create educational material from your expertise and monetise that IP from selling the value in the created content.

- License your IP for a fee, and earn an income from conducting business differently.

- Innovate to overcome adversity, conduct research studies and sell the information to larger entities who require such data for their R&D initiatives.

As you can see from the few ideas mentioned above, there are options. Do not feel like you have nowhere to turn. Instead, seek out other open channels. If the door is closed, try the window. If the window is closed, climb onto the balcony. Search until you find a way out, or forward. Business is much like life. As the well-known saying by Pauline Kael “Where there is a will, there is a way.”

The team at Strategy Hubb are well suited to dealing with uncertainty. We connect the unconnected, and we provide perspective from multiple directions. We mitigate risks, expand value across enterprise, and strengthen business, especially in a recession. You have nothing to lose and everything to gain when you engage our specialist team who can design a strategy specifically for you and your business. Reach out and make contact today—direct message Ryan for an exploratory chat. https://www.linkedin.com/in/ryan-babbage-20aa5025/

Disclaimer

This material contains a general explanation of the economic outlook as of July 2020. It is not intended to constitute or be relied upon as personal or business advice. It has been prepared without taking into account your objectives, financial situation or needs. Because the information is general in nature, you should, before acting on it, consider the appropriateness of the advice. We (Strategy Hubb) recommend that you seek your own independent legal or financial advice before proceeding with any business strategy or investment decisions.